Image Source: Created by Vending Connection

As Ozempic and other GLP-1 weight-loss drugs surge in popularity, vending machine operators may be facing an invisible shift in consumer behavior — one that could redefine what sells, where, and to whom.

A study published in December 2024 from researchers at Cornell University reveals the dramatic reshaping these medications are doing to the American diet. In other words: Your vending or refreshment businesses are not immune.

What Are GLP-1s?

GLP-1 medications such as Ozempic, Wegovy, and Mounjaro were originally designed to treat type 2 diabetes; these drugs are now widely used to support weight loss and appetite control. The effect? Consumer snacking behavior — and what people ultimately snack on.

What Do They Do?

Here are a few effects:

- Reduce hunger

- Slow digestion

- Stabilize blood sugar

- Curb cravings

Appetite Suppression

GLP-1 medications like Ozempic, Wegovy, and Mounjaro, originally prescribed for diabetes and now widely used for weight loss, are proven to suppress appetite. That’s not just a clinical side effect — it’s showing up in real-world purchasing behavior.

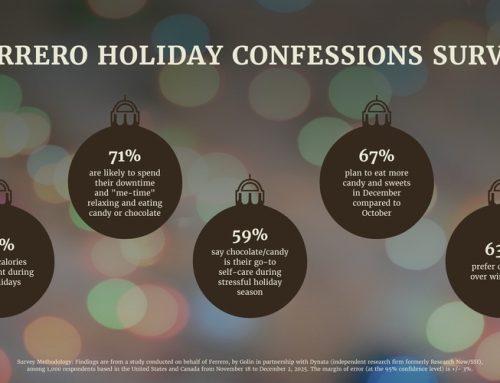

In households where someone takes a GLP-1 medication, grocery spending drops by 5.5% on average within six months, and snack categories see the steepest declines.

Here are a few instances that directly affects your business:

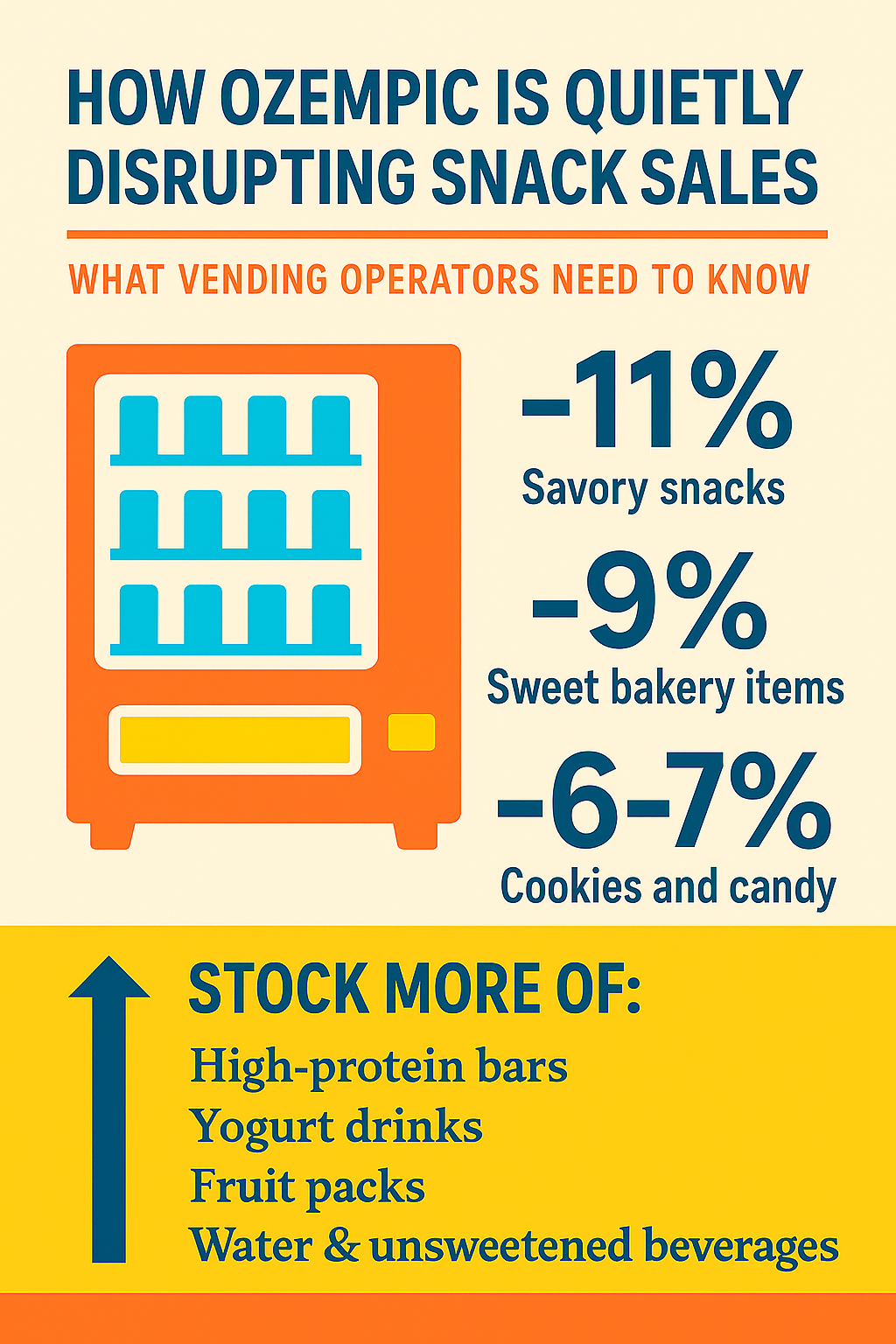

- Savory snacks (like chips): down approximately 11%

- Sweet bakery items: down approximately 9%

- Cookies and candy: down approximately 6–7%

These are major categories for vending.

From vending to micro markets to hotels, food and beverage spending can potentially drop 10%. Fewer cravings lead to fewer trips, which lead to fewer purchases — aka decreased profits for you.

Image Source: Created by Vending Connection

Should you be concerned about losing profits?

While this study did not track vending purchases specifically, the parallels are clear. Vending machines — especially in breakrooms, campuses, and transit hubs — heavily rely on impulse snacking and high-calorie grab-and-go items. And those are exactly the kinds of products consumers are skipping after starting GLP-1 medications.

Further compounding the challenge, lower-income consumers (a significant base for value vending options) showed a 14% decline in spending at fast-food and quick-service restaurants — suggesting a similar trend may play out in other convenient food environments.

“I’m hearing it more and more — people are talking about Ozempic and what they should be eating,” said Matthew Rainey, CEO of Surpass Refreshments.

Increase Profitability with Healthy Items

It may feel like everything is shrinking — even the products, right? Well, not everything is shrinking.

Nutrient-dense products like yogurt, produce, and nutrition bars held steady, with some adoption groups showing small gains. Vending operators should take note.

What to stock more of:

- Low-sugar, high-protein snack bars

- Shelf-stable yogurt drinks

- Fresh or dried fruit packs

- Water and unsweetened beverages

And while the study found no major change in alcohol or coffee spending, soft drinks and energy drinks did decline, especially in health-conscious users.

Is this change permanent or temporary?

Interestingly, GLP-1 medication use appears to be seasonal, similar to gym memberships. “People may go on and off these drugs in cycles,” said researchers, suggesting that vending sales may see periodic dips tied to New Year’s resolutions, summer prep, or insurance renewals.

In addition, in an exclusive interview with Food Dive, CEO of the biggest yogurt company said he believes it’s not going away anytime soon. “We do believe that this is not a fad,” said Rafael Acevedo, president of yogurt at Danone North America in the interview. “This is a trend that is here to stay.”

What Vending Operators Should Consider:

Rethink SKUs and formats:

Single-serve, portion-controlled, and “functional” snacks are becoming the new winners in vending. The era of king-size candy bars and jumbo chips may finally be fading for this audience.

Watch your locations:

Breakrooms at tech firms, medical facilities, and higher-income offices may see the earliest and sharpest shifts in demand, as GLP-1 usage skews toward younger, wealthier, and weight-conscious consumers.

Lean into health marketing:

Some CPG brands are already rolling out “GLP-1 Friendly” labels. Your machines should signal better-for-you options clearly — with signage, digital screens, or product clustering.

Consumer Behavior Is Changing

GLP-1 drugs aren’t just changing waistlines — they’re changing what people reach for when hunger hits. For vending operators, this is both a challenge and an opportunity: as always, early adopters will come out on top. The post-Ozempic consumer will quietly be changing purchasing behavior — possibly permanently.

This piece was written by Rebecca Swindale, Managing Editor of Vending Connection. Have a topic you’d like us to explore? Reach out!