Cashless And Other Technologies Poses Hard Choices; Experts Weigh In At NAMA OneShow

The cashless revolution in vending has offered vending operators new opportunities to increase sales, improve customer satisfaction and reduce many of the costs associated with cash. But cashless is not the only technology vending operators have to consider to be competitive in today’s refreshment services industry.

The cashless revolution in vending has offered vending operators new opportunities to increase sales, improve customer satisfaction and reduce many of the costs associated with cash. But cashless is not the only technology vending operators have to consider to be competitive in today’s refreshment services industry.

The different choices operators face in deciding which system to invest in, and in knowing how aggressively they need to transition to new technology, forces them to carefully examine their options.

A session during the National Automatic Merchandising Association OneShow in Las Vegas gave operators insight into the impact cashless payment and other technologies can have on their business and an overview of the different technologies.

Moderator Michael Kasavana, Ph.D., NAMA endowed professor emeritus, introduced the session, titled, “What’s Trending in Vending Coffee Services and Micro Markets.” Kasavana noted at the outset that the industry is moving away from its legacy model of “reverse retailing” to what he calls “V-Commerce.” Reverse retailing refers to having to first pay to receive a product. The term, “V-Commerce,” by contrast, refers to virtual commerce, whereby machines enhance the interface between consumers, products, payment and even the equipment itself.

Technology Adoption Accelerates

Paresh Patel, CEO of PayRange, said vending innovation has accelerated in the last five years faster than in the previous 20. He identified five stages of technological progress the industry has witnessed: 1) filling the machine, 2) reducing operating costs, 3) expanding the business, 4) upgrading the business, and 5) engaging customers.

The first stage began decades ago when vending machines were simple in design and operators focused on keeping them clean, filled and working.

Stages two through five have happened in fairly rapid succession. The second stage saw the advent of vending management systems and DEX machine technology. DEX provided more information that enabled cost reduction. DEX technology fostered pre-kitting, pick-to-light inventory management, dynamic routing and dynamic service scheduling.

Stages two through five have happened in fairly rapid succession. The second stage saw the advent of vending management systems and DEX machine technology. DEX provided more information that enabled cost reduction. DEX technology fostered pre-kitting, pick-to-light inventory management, dynamic routing and dynamic service scheduling.

The third stage witnessed business expansion, delivering more machines, more routes and more acquisitions among operating companies.

The fourth stage, upgrading the business, involved installing new control boards, drop sensors, cashless readers, LED lighting and micro markets.

The fifth stage, which is what’s happening at the present time, is the most exciting stage since the industry is engaging with consumers. New technology allows for a higher level of customer engagement, and operators who want to grow need to be doing it to succeed.

Engage The Consumer

The e-commerce industry was in a similar situation 10 to 15 years ago, Patel noted. E-commerce companies that succeeded, such as Amazon, were those that figured out how to engage consumers. Companies that can figure out who their customers are can get more business from them.

Engaging the consumer requires establishing a “one on one” level of personalization.

The first technique in accomplishing this personalization is to deploy digital signage. “Digital signage is a way for you to start sending messages to that machine,” Patel said.

The next step is to install digital displays mixed with sensors that can deliver analytics.

The future, according to Patel, is mobile interaction with the consumer.

The Global Perspective

Yair Nechmad, CEO of Nayax, focused on the global adoption of cashless payments. He compared the different types of cashless technologies dominant in different continents. Consumers everywhere want to use mobile payments, he said.

Because there are different types of cashless payment systems available, vending operators should make sure that the system they invest in will last as long as the vending equipment that it serves, which is typically 10 to 15 years, Nechmad said.

Customers Embrace Cashless

Anant Agrawal, president, co-founder and chief revenue officer of Cantaloupe Systems, focused on customer preferences when it comes to cashless. He said 64 percent of consumers who are 40 and under prefer cashless payment. Cashless payment increases spending 33 percent on average, Agrawal said. He also noted that 38 percent of vending sales today are cashless.

Because consumers are willing to spend more when using cashless, it allows operators to offer more premium products in the machine.

“Consumers are already there,” Agrawal said.

In addition to increasing sales, cashless payment systems reduce cash handling costs and cash shrinkage, and eliminate external theft.

Agrawal said one mid-sized vending operator calculated he saved $156,000 from reduced cash handling. Another estimated he saved $155,000 in reduced money room labor.

The data that cashless payment systems provides delivers insights in sales trends. Such data can also help find ways to reduce waste.

“All these things add up,” Agrawal said. Mike Lawlor, chief service officer at USA Technologies Inc., reinforced Agrawal’s points on the benefits of cashless.

Lawlor presented a slide showing the percentage of total sales that credit cards comprise for different machine types. Credit accounts for 40 percent of soft drink machine sales, 38 percent of beverage/snack combo machine sales, 35 percent of snack machine sales and 34 percent of coffee machine sales.

At college and university vending machines, 40 percent of sales are made with credit and debit cards, 34 percent with campus issued cards and 26 percent with cash.

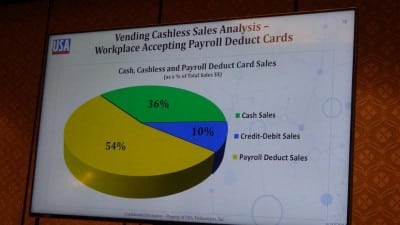

For worksite machines that offer payroll deduct, the payroll deduct option accounts for 54 percent of sales, cash comprises 36 percent and credit and debit cards represent 10 percent.

But while credit and debit cards are the least commonly used option in machines that offer payroll deduct, the cards still command higher per sale spending. The average credit or debit card spend is $1.67 in these machines, compared to $1.34 for payroll deduct and $1.13 for cash.

In micro markets offering payroll deduct, the payroll deduct becomes the preferred payment method, Lawlor said.

When a consumer loads a prepaid micro market card with a credit or debit card, they put 96 percent more money on the card than if they use cash, Lawlor said. He said consumers spend 53 percent more using a prepaid card or a credit card at a micro market.

While mobile wallets have been introduced for several years now, consumers have not yet embraced them, Lawlor noted.

Technology News | More News | Vending Newsletter sign up | Questions? Contact us | email press release |

Also see: Software Companies | Technology Companies | Micro Markets | Cashless Vending | Distributors | Classified Ads | Home |

VENDING YELLOW PAGES DIRECTORIES:

Call us at 1-800-956-8363 to POST YOUR COMPANY, or QUESTIONS?